Beximco’s severe cash crunch may be eased by Sonali Bank

Bangladesh’s state-owned Sonali Bank (SB) has decided to reschedule Tk 982.44 crore of Bangladesh Export Import Company (BEXIMCO) Limited’s loans and extend the repayment period to 2026 to help the conglomerate ride out its severe cash crunch and continue commercial operations.

Beximco’s loan rescheduling proposal was approved in entirety last week by the Sonali bank’s board, and a letter was sent to the central bank of Bangladesh, the Bangladesh Bank (BB) for it’s final approval.

Under existing rules, Sonali bank is not allowed to reschedule Beximco’s loans as it did so more than three times already. Furthermore, Beximco itself has proposed extension of the repayment period but it would not be making any down payment for it, Sonali Bank said in the letter to the central bank.

Sonali’s latest move comes after vice-chairman of Beximco Mr. Salman F. Rahman approached the state bank with a debt restructuring plan in August.

Mr. Zaid Bakht, a director of Sonali Bank, said the bank has decided to reschedule Beximco’s loans and declassify them, considering the company’s socio-economic contribution. If the company continues to be classified, it will not get any further loan facility and will not be able to run its business activities, he added.

Sonali, however, has tagged conditions to the rescheduling.

Beximco will have to pay the instalments regularly, once the repayment period begins. If the company fails to repay two instalments in a row, the bank will cancel the new facilities and Beximco will again be classified, said Mr. Bakht.

Under the plan, Beximco will have to repay its short-term loans of Tk 340.83 crore by 2024 with the repayment period starting from April 2016. It will enjoy a grace period of one year and six months before the first instalment. It will have to start repaying its long-term loans of Tk 641.83 crore from October 2016 and will have until September 2026 to repay them. It will enjoy a grace period of two years.

The bank will charge 10 percent interest rate on both the short and long-term loans, much lower than the market rate of 13-14 percent, according to bank officials.

In August, vice-chairman of Beximco Mr. Salman F. Rahman also wrote a letter to the central bank about his company’s severe cash crunch, and prompting BB to send letters to all seven banks that have lent to Beximco Ltd.

Beximco Ltd., the largest company of Beximco Group, is listed on the stockmarket. It operates in multiple industrial areas, including textiles, real estate, hospitality, marine food, commodities trading, ICT, ceramics and aviation.

The company is seeking rescheduling facilities from all the banks it has borrowed from for its textiles and garments factories. Its outstanding loans for its garments and textile businesses stand at Tk 5,269 crore. Beximco Ltd, however, is not the only company that owes a lot of money to banks.

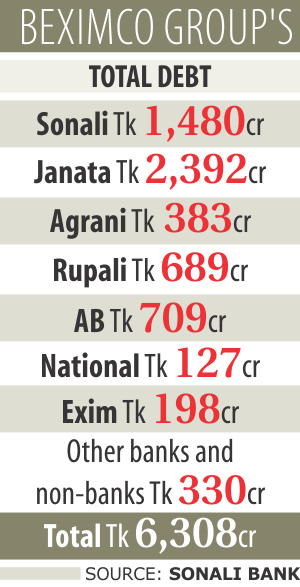

In fact, Beximco Group is a major borrower of the banking sector, with its outstanding loans as of September 30 this year standing at Tk 6,308 crore. Of the sum, Tk 1,480 crore is with Sonali.